california mileage tax bill

Today this mileage tax. California Department of Tax and Fee Administration.

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

When business raise prices on goods to cover the cost of a mileage tax the state collects more sales tax revenue.

. But opponents are concerned the legislation is laying. The California Department of Transportation is launching four pilot programs in early. Gavin Newsom signed into law a bill that expands a pilot program that tests whether a tax on miles driven might work better to fund road construction and repair than a tax on fuel purchases.

Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. California has announced its intention to overhaul its gas tax system. Install a mileage recorder or do like what they do with kellys blue book.

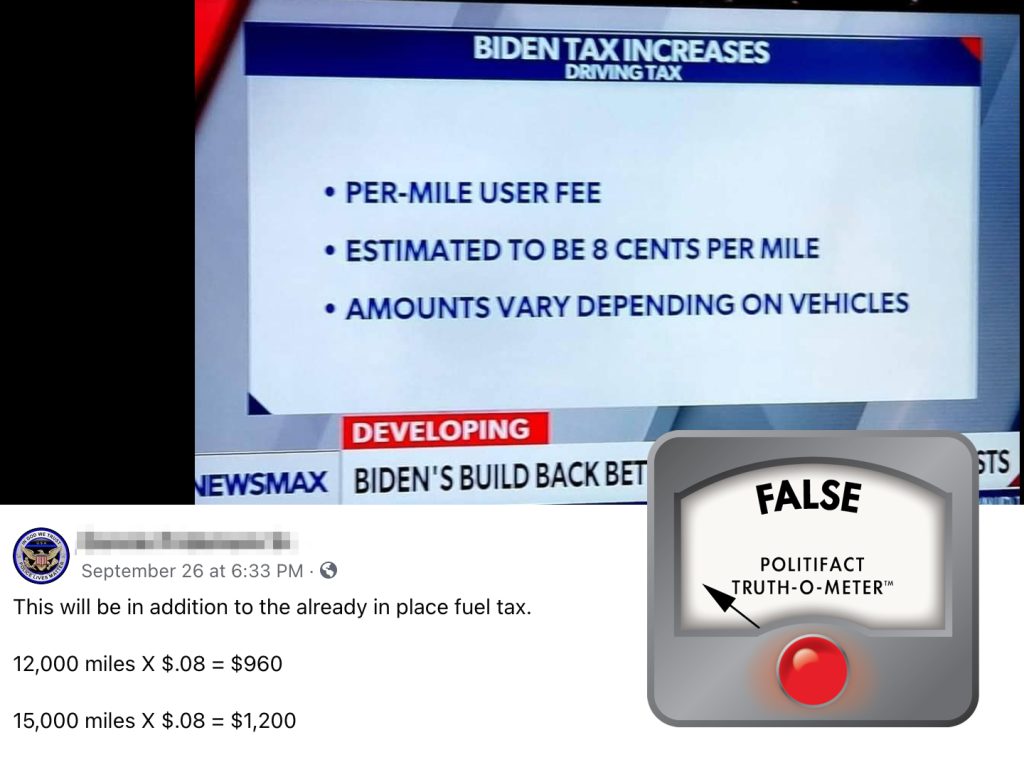

The 12 trillion infrastructure bill does not include a driving tax It includes a voluntary pilot program to study a per-mile user fee. California Tests Mileage Fee Plan as Answer to Dwindling Gas Tax. This money helps keep both local roads and state highways in good repair.

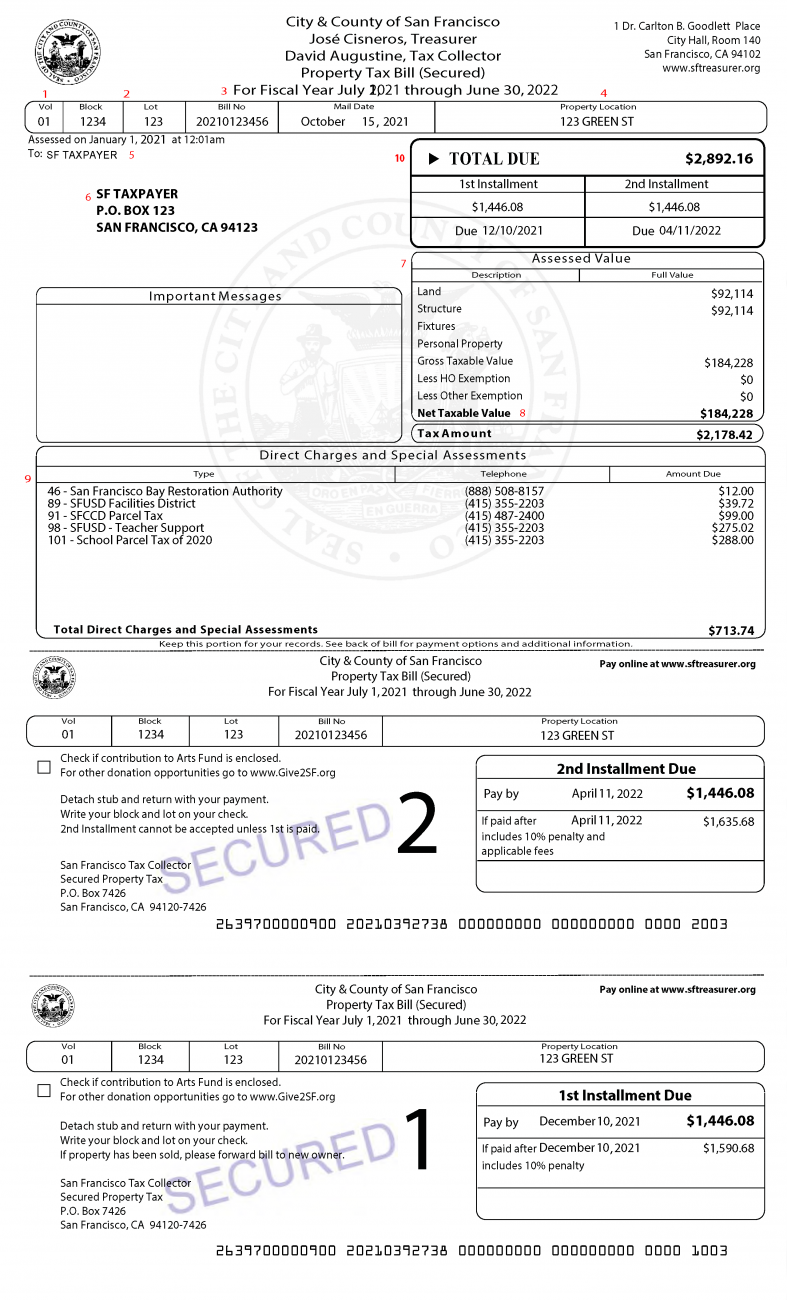

California Expands Road Mileage Tax Pilot Program. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified.

This means that they levy a tax on every gallon of fuel sold. Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. Instead of paying at the pump when purchasing fuel a mileage tax system determines a drivers vehicle miles traveled with.

Have found Florida to be much. The California Road Charge Pilot Program is billed as a way for the state to move from its longstanding pump tax to a system where drivers pay based on their mileage. The California Legislature has passed a bill that authorizes a pilot program for a vehicle miles traveled tax.

But as cars get more fuel efficient or use other energy sources the gas tax will no longer fund the infrastructure California needs. In reality the vehicle mileage tax program that is included in the infrastructure bill proposes a three-year pilot program to study the viability of a road user charge. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

The pilot program will ask drivers to volunteer to. Californias Proposed Mileage Tax. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg.

California is looking at new ways to pay for road and other transportation projects as officials brace for falling gasoline and diesel taxes due to the transition to zero-emission vehicles. The bill would require that the pilot program not affect funding levels for a program or purpose supported by state fuel tax and electric vehicle fee revenues. On average Californians pay about 280 a year in state gas taxes that are charged at the pump when a driver buys gas.

The money so collected is used for the repair and maintenance of roads and highways in the state. The money so collected is used for the repair and maintenance of roads and highways in the state. The California legislature passed a bill extending a road usage charge pilot program.

California is researching a potential gas tax replacement thats both sustainable and equitable. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under. The program would begin in 2022 and after the three-year period is up it may be voted into law by Congress.

I have been resisting against all common sense leaving California completely. I dont want to sell my home but it is time. The vehicle miles traveled tax has been proposed as a potential replacement for the states fuel tax.

California is the second state to test mileage fees in recent years joining Oregon which launched a pilot program of its own in 2014. Tags Fuel tax Gas Tax Highway bill Vehicle miles traveled tax. Traditionally states have been levying a gas tax.

Other state fees also fund transportation and some counties also charge a local sales tax to further invest in road and transit needs. California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. California mileage tax bill.

The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code. Traffic flows past construction work on eastbound Highway 50 in Sacramento California. Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile Employees will receive 17 cents per mile driven for moving or medical purposes this is a substantial increase from just 2 cents per mile in 2018.

Jerry Brown signs SB1077 the state will create a task force that will develop the pilot.

Local Mayors Get Cold Feet On Plans For Mileage Tax On San Diego Drivers By 2030 Kpbs Public Media

Pros And Cons Of A Vehicle Mileage Tax Glostone Trucking Solutions

County City Leaders Push Back Against Proposed Mileage Tax

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters

What San Diegans Should Know About The 160b Plan For Transit And Road Charges Approved On Friday The San Diego Union Tribune

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Vehicle Miles Traveled Tax Proposed

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

Secured Property Taxes Treasurer Tax Collector

What Are The Mileage Deduction Rules H R Block

Everything You Need To Know About Vehicle Mileage Tax Metromile

Opinion San Diego Drivers Shouldn T Be Taxed On The Miles They Drive Times Of San Diego

Irs Raises Standard Mileage Rate For 2022

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group